renounce green card exit tax

The process is straightforward. Renouncing provides relief from the US.

Surrendering A Us Passport Htj Tax

Persons abroad ExpatriationLaw November 21 2020 Its critically important to understand that Green Card holders who are long term residents may.

. Tax regime but it is not for everyone. Citizens who have renounced their citizenship and long-term residents as defined in IRC. After being a holder for 8 or more of the.

Avoiding the Exit Tax Every year more and more US. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. T he exit tax.

Currently net capital gains can be taxed as high as. The tax calculation assumes that you hypothetically sell all of your assets on the date before you gave. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or.

Sign some documents answer some questions pay a 2350 fee and make an oath in front of a US. If you are deemed as covered expatriate then it is necessary to pay an exit tax. To put this simply if you held your Green Card for a total of 8 years not sequential in the 15 period before giving it back you are subject to the exit tax.

Citizens renounce their citizenship and green card holders give up their visa status. This is known as the green card test. Citizens who relinquish citizenship and green card holders who renounce their status and leave the US.

You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration. If an Israeli decides to renounce he or she must take precautions to avoid the imposition of the US. Consular official to voluntarily renounce.

Section 877A g 6 provides that the term early distribution tax means any increase in tax imposed under sections 72 t 220 e 4 223 f 4 409A a 1 B 529 c 6 or 530 d. The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market value on the day before expatriationThe current. John Richardson lawyer for US.

This is required for certain US. These actions trigger a tax problem. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

Exit Tax Us After Renouncing Citizenship Americans Overseas

The Tax Consequences Of Renouncing Us Citizenship

Guide To Renouncing Us Citizenship Us Tax Services

Renouncing Us Citizenship Expat Tax Professionals

Americans Gave Up Citizenship In Record Numbers In 2020 Up Triple From 2019 Reports Tax Specialists Americans Overseas

Form I 407 How To Relinquish Your Green Card

Exit Tax Us After Renouncing Citizenship Americans Overseas

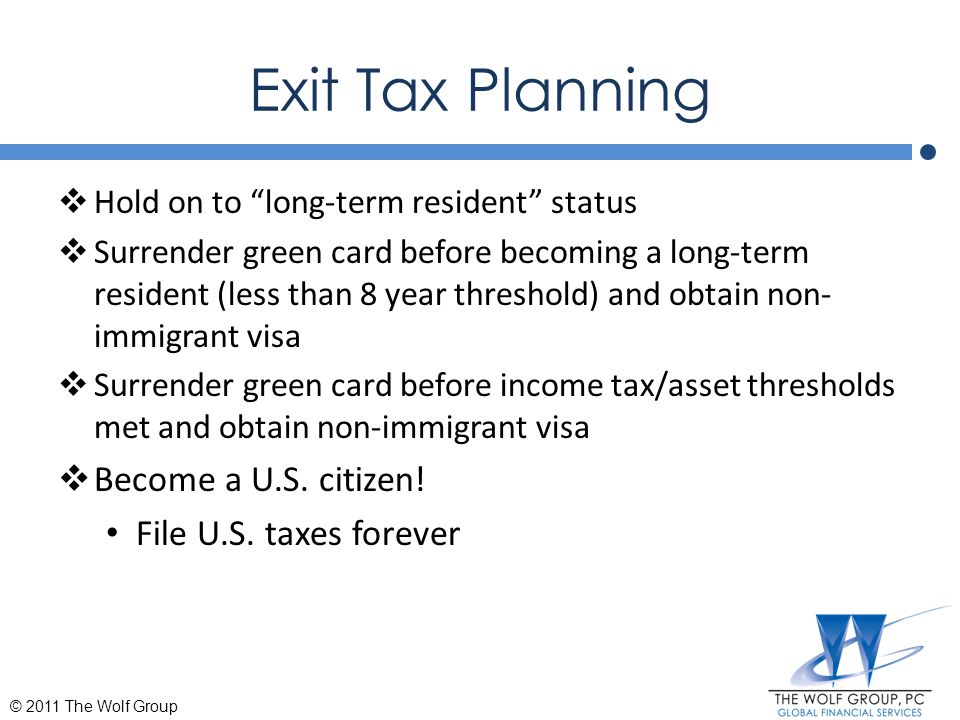

Exit Tax Planning To Avoid Minimize Expatriation Exit Tax Withum

Exiting The U S For U S Citizens And Long Time Residents Is A Taxing Process

Renounce U S Here S How Irs Computes Exit Tax

Dale Mason Cpa Robert Len Cpa Pfs The Wolf Group Ppt Video Online Download

Us Tax Implications Worldwide Income For Green Card Holders

Green Card Archives U S Citizens And Green Card Holders Residing In Canada And Abroad

Never Give Up Or You Ll Be Surprised

When U S Citizenship Starts Looking Like A Bad Deal The New York Times

Exit Tax Us After Renouncing Citizenship Americans Overseas

U S Exit Tax Orlando International Tax Lawyer